By Ken Kirwin, CFO

By Ken Kirwin, CFO

Did you know that by 2022, 100% of our funds will be ESG screened? This means you can feel good knowing your investments are being screened with a set of criteria for socially conscious investing. Environmental screens consider stewards of nature; social criteria examine how companies manage relationships with employees, suppliers, customers, and the communities where they operate; and governance looks at a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

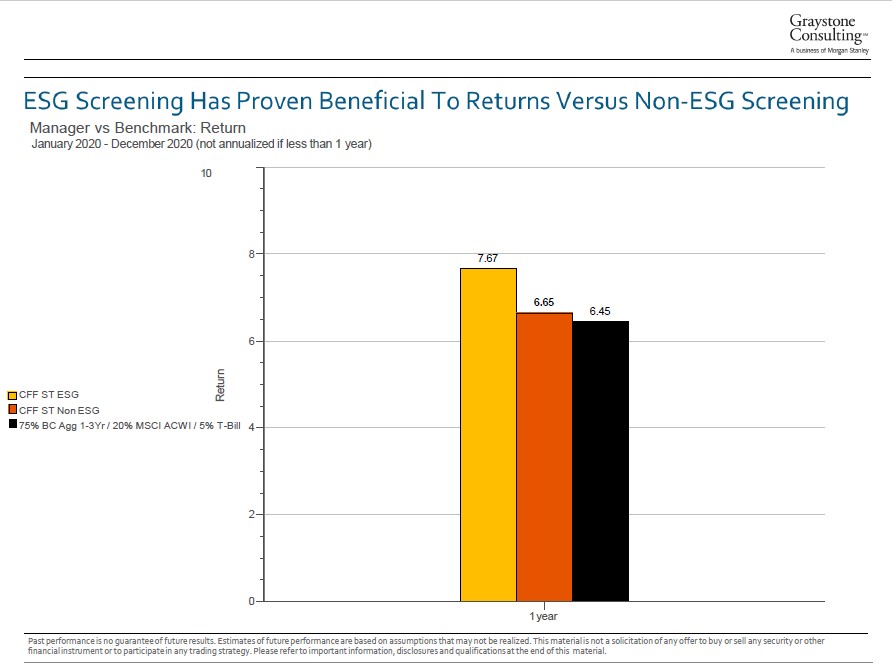

At our annual investor meetings, we discuss ESG investing – what it is, what we have done to date, and what we are considering for the future. The Foundation has been keeping a pulse on ESG for several years and has been broadly applying ESG screens to our unrestricted fund for almost two years. When we began exploring ESG, we believed we would be required to sacrifice return in order to apply these value screens to our portfolio. We have learned through research and our own experiences that this is not true. To date, ESG strategies have actually met or outperformed non-ESG peers or benchmarks. (Read the latest info – pages 42-48)

We have also learned that ESG-screened investments can provide these commensurate returns with less risk. Morgan Stanley has studied this with data from 2004 to 2018 on nearly 11,000 funds/managers and, according to Graystone, has seen a 20% smaller downside deviation from ESG strategies compared to traditional. Here is a whitepaper prepared by Morgan Stanley that explains this in more detail and below are some FAQ’s. Intuitively, we believe that companies with ESG practices are better able to avoid corporate scandals and other events that would adversely affect shareholder value.

With the ability to direct investments to companies that are prioritizing sustainability without sacrificing returns and decreasing the risk in the portfolio, our board is considering broadly applying ESG screens to the long-term portfolio. While ESG is often thought of as a values-based approach, we believe ESG also makes sense from an investment perspective.

As ESG has been maturing as a tool, Community First Foundation has been working to understand when and how it makes sense to introduce into the portfolio. I hope you see our efforts in this area as another benefit you receive from our relationship.

ESG stands for Environmental, Social and Governance. An investment made with the intention of generating a measurable, positive social and/or environmental impact alongside a financial return.

While the use of ESG screens can focus investments in firms that are responsible businesses working towards positive goals, the application of the ESG screens will also select out companies that are not focused on these behaviors. By removing these companies from the portfolio, the overall risk of the portfolio should be reduced – without the need to sacrifice returns. See white paper prepared by Morgan Stanley above.

ESG screens are applied to registered securities and can be used on investment throughout the world. It is not practical to limit ESG screening to a local community. Community First Foundation makes local impact through grantmaking and targeted impact investments.

Screening out tobacco, firearms and alcohol is a restriction screening and an issue-based approach. A portfolio can screen these activities out so that no portion is invested in the specified area. In an ESG approach, the portfolio uses criteria to identify companies that are focused on making systemic changes in areas such as climate change, natural resource use, water scarcity, employee treatment, human rights, ethical practices, diversity in leadership, etc.

There are investments strategies that attempt to identify ways to lower volatility within the portfolio based on historical performance of specific companies. An ESG strategy, however, is rooted in the structure of the company’s fundamental behavior, with the intent that this will produce lower risk in the future.

Because there are 130 nonprofit partners invested in the portfolio, it is not possible to identify a set of values-based investment that will be common to all. Community First Foundation will apply broad ESG screens that will focus on selecting companies that are “doing good”. Our real goal is to employ ESG screens to identify companies that are actively managing their environmental and operational risks to reduce the overall risk in the portfolio.

Some companies have identified their impact on the environment as a priority and are working to address their impact. Some have set goals of being carbon neutral by a specified date while others are investing in technologies to reduce the world’s dependence on fossil fuels. But not all ESG screens are focused on climate change. Some companies are more focused on other environmental, social or governance issues. Please refer to the attached ESG presentation from the annual investment meeting.